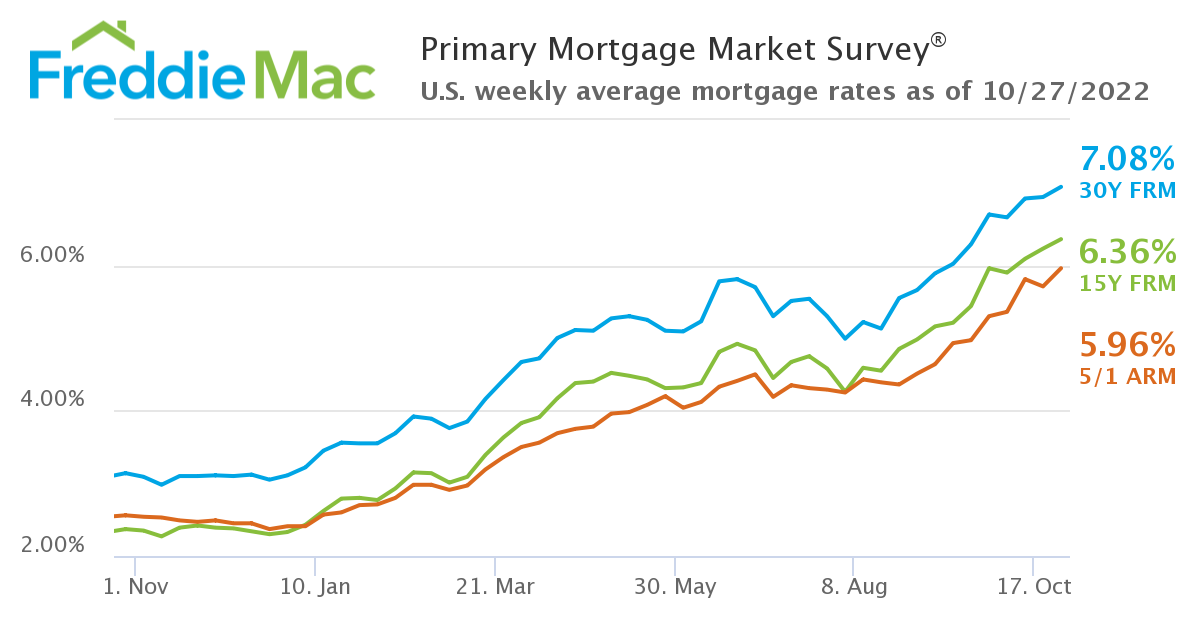

For the first time in two-plus decades, the 30-year fixed-rate mortgage (FRM) has passed the 7% mark, as Freddie Mac reported the 30-year FRM averaging 7.08% with an average 0.8 point for the week ending October 27, 2022, up from last week when it averaged 6.94%. A year ago at this time, the 30-year FRM averaged more than half that total when it stood at 3.14%.

“The 30-year fixed-rate mortgage broke 7% for the first time since April 2002, leading to greater stagnation in the housing market,” said Sam Khater, Freddie Mac’s Chief Economist. “As inflation endures, consumers are seeing higher costs at every turn, causing further declines in consumer confidence this month. In fact, many potential homebuyers are choosing to wait and see where the housing market will end up, pushing demand and home prices further downward.”

As rates climbed to cross a 20-year high, many eagerly await the outcome of next week’s Federal Open Market Committee (FOMC) meeting. The Fed has increased the nominal interest rate by 75-basis points at the conclusion of two-day meeting in late September, marking the highest interest rate in 14 years. September’s rate hike marked the fifth increase in 2022 alone and the biggest consecutive rate hike on record, having raised rates in March (+25 points), May (+50 points), June (+75 points), and August (+75 points).